日本监控加密货币:趋势、挑战与未来展望

随着数字经济的飞速发展,加密货币已经成为全球金融市场的一大亮点。在日本,这一趋势同样显著。根据市场研究,越来越多的日本人开始接触和投资于比特币、以太坊等各种加密货币。然而,伴随着加密货币的崛起,随之而来的还有诸多挑战,尤其是在监管和监控方面。监管机构需要找到合适的方式来有效监控加密货币市场,以确保金融安全和消费者利益不受损害。

#### 日本加密货币的现状日本是全球第一个对加密货币进行合法化的国家之一。2017年,日本通过了《资金融通法》,将加密货币视为合法的支付手段。如今,日本的加密货币交易所数量众多,市场交易活跃,交易所如bitFlyer、Coincheck等已成为国际知名的平台。同时,日本的加密货币市场也吸引了大批国际投资者,形成了一种独特的市场生态。

目前在日本,最受欢迎的加密货币包括比特币、以太坊、瑞波币等。这些加密资产不仅仅是投资产品,很多企业还利用它们进行快速支付和跨境交易,大幅提升了交易的效率。

#### 监管政策背景在日本,加密货币的监管相对严格。主要由日本金融服务局(FSA)负责监管,这一机构自2014年起加强了对加密货币交易所的监管力度。日本的法律法规涵盖了对交易所的登记、客户资产的安全保护以及反洗钱(AML)和反恐怖融资(CFT)的措施。

例如,为了保护投资者的利益,日本FSA规定交易所必须遵守KYC政策,即在客户开户时需要进行身份验证。这项政策不仅有助于防止欺诈活动,也能够为交易提供一定程度的透明度。

#### 监控加密货币的必要性由于加密货币的匿名性和去中心化特性,它为一些不法分子提供了可乘之机。例如,通过加密货币现象,洗钱、恐怖融资等活动在一定程度上变得更加隐蔽。因此,建立有效的监控机制显得尤为重要。

监控加密货币不仅可以保护投资者的利益,还能维护金融市场的稳定。此外,随着加密货币的普及,市场中出现越来越多的诈骗行为,政府对市场的监管可以有效减少此类事件,提升公众对加密货币的信任度。

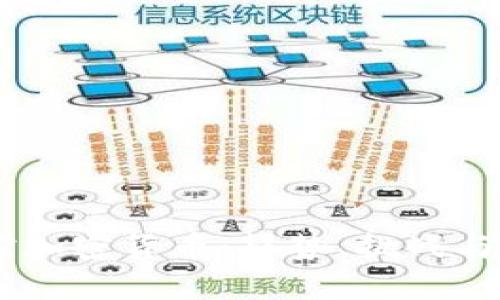

#### 技术手段与方法为了有效监控加密货币市场,日本各大监管机构开始使用一些先进的技术手段。例如,区块链分析工具可以帮助监管机构追踪资金流动,识别可疑活动。实际上,很多区块链分析公司,如Chainalysis等,已经为全球的监管机构提供了专业的服务,帮助他们了解加密货币的流动情况。

此外,KYC政策的实施也在帮助监管机构识别潜在的非法活动。通过收集客户资料,交易所能更好地了解其客户,降低风险。

#### 日本在加密货币监控中的挑战尽管日本在加密货币监管方面走在前列,但仍然面临诸多挑战。首先是法律框架的滞后,随着加密货币技术的迅速发展,现有的法律法规已经无法完全适应新的市场形势。这就要求监管部门不断更新和完善法律法规,以适应市场的变化。

其次,技术方面的挑战同样不容忽视。虽然区块链分析工具能够帮助监控,但对于某些加密货币,如门罗币(Monero)等,更加强调匿名性,这无疑增加了监控的难度。此外,社会公众对加密货币的了解程度有限,缺乏基本的金融知识也使得监管工作更加复杂。

#### 未来发展与展望展望未来,日本的加密货币监管有望迎来新的发展。随着相关法律法规的不断完善,未来很可能会出台更为细化的监管措施,进一步规范市场。同时,越来越多的技术手段也将被引入,以提高监管效率。

此外,日本在全球加密货币监管中的角色将愈加重要。作为全球加密货币的一个重要市场,日本的经验和做法将对其他国家的监管政策形成借鉴。希望在不久的将来,能够建立一个更加安全、透明且高效的加密货币市场。

#### 结论总的来说,日本的加密货币市场已然成为全球金融市场的重要组成部分。在面对加密货币带来的诸多挑战时,监控的有效性不容小觑。只有通过先进的技术手段和完善的监管制度,才能确保加密货币市场的健康发展。随着监管政策的不断完善和技术的进步,日本在全球加密货币监控中将扮演越来越重要的角色。

### 相关问题及介绍 #### 日本加密货币的法律框架是怎样的?日本加密货币的法律框架是怎样的?

日本的加密货币法律框架主要基于《资金融通法》。该法律于2017年生效,标志着日本对加密货币的合法化。根据该法规定,加密货币被视为一种“货币”,并受到监管,交易所需经过FSA的登记与批准。法律框架的成立保证了投资者的权益,并为加密货币市场的健康发展奠定了基础。

此外,FSA还制定了多项指引,以确保交易所以合规的方式运营。比如,交易所必须实施反洗钱(AML)和了解你的客户(KYC)政策,以防止非法交易和洗钱活动。这些规定不仅帮助监测市场,同时增强了公众信心。

日本政府还与国际组织密切合作,分享关于加密货币的监管经验与信息,以应对全球范围内的金融犯罪。未来,随着加密货币的演变,日本法律框架也可能进一步更新,以适应新兴技术和市场的发展。

#### Japan's Financial Services Agency (FSA) role in cryptocurrency regulation?Japan's Financial Services Agency (FSA) role in cryptocurrency regulation?

The Financial Services Agency (FSA) of Japan plays a pivotal role in the regulation of cryptocurrencies. Founded in 2000, the FSA oversees and ensures the integrity of Japan's financial system. The FSA became particularly involved with cryptocurrencies following the infamous Mt. Gox hack in 2014, which highlighted the vulnerabilities in the unregulated crypto market.

To address these challenges, the FSA introduced new regulations under the Payment Services Act, officially recognizing cryptocurrencies as a legal method of payment in Japan. The agency requires cryptocurrency exchanges to register and comply with stringent standards, including implementing anti-money laundering (AML) and know-your-customer (KYC) procedures to trace illicit activities.

Additionally, the FSA monitors exchanges for security practices and legal compliance, regularly conducting inspections. The agency's proactive stance aims to bolster consumer protection, prevent fraud, and enhance market stability. The FSA's model is often referenced by other nations looking to develop their cryptocurrency regulatory frameworks.

#### What challenges does Japan face in cryptocurrency monitoring?What challenges does Japan face in cryptocurrency monitoring?

While Japan has established a reputation as a leader in cryptocurrency regulation, it still faces significant challenges in monitoring these digital assets. One primary issue is the rapid evolution of technology and the emergence of new cryptocurrencies, which can outpace existing regulations.

Additionally, the decentralized nature of cryptocurrencies complicates tracking and monitoring transactions. Some cryptocurrencies prioritize anonymity, making it difficult for regulators to trace transactions and identify malicious activities.

Furthermore, the lack of public understanding of cryptocurrencies can present hurdles for regulatory compliance. Many everyday users may be unaware of the risks associated with cryptocurrency investments, leading to potential scams and market manipulation.

Cybersecurity threats also pose a challenge; exchanges are vulnerable to hacking incidents that can lead to significant financial losses. This underlines the importance of robust security measures and regulatory oversight. Lastly, as international jurisdictions begin to implement their own regulations, Japan needs to navigate a complex global landscape, ensuring that its regulations are both effective and harmonized with other nations.

#### How does Japan implement Know Your Customer (KYC) policies in cryptocurrency exchanges?How does Japan implement Know Your Customer (KYC) policies in cryptocurrency exchanges?

In Japan, Know Your Customer (KYC) policies are integral to the operations of cryptocurrency exchanges, mandated by the Financial Services Agency (FSA) to prevent illicit financial activities such as money laundering and fraud. Initially, clients wishing to trade on an exchange must undergo a verification process to establish their identities.

This verification process typically involves submitting personal information, including a government-issued ID, proof of residence, and sometimes even biometric data. The exchanges utilize these documents to confirm the identity of their users, which serves as a deterrent against malicious activity.

The KYC process in Japan is not just a one-time requirement; it has ongoing components. Exchanges are required to monitor transactions for suspicious activities continuously. If certain thresholds are met—such as unusually large transactions—exchanges must take additional measures to verify the legitimacy of these transactions, which could include reaching out to users for further information.

Additionally, KYC helps in building a database of cryptocurrency users, which can aid in tracking down any potential involvement in illegal activities. This regulatory framework aims to strike a balance between user anonymity, a core principle of many cryptocurrencies, and the necessity of safeguarding the financial system.

#### What is the role of blockchain analysis tools in monitoring cryptocurrencies in Japan?What is the role of blockchain analysis tools in monitoring cryptocurrencies in Japan?

Blockchain analysis tools have become essential in Japan's efforts to monitor cryptocurrencies effectively. These sophisticated tools utilize algorithms and analytics to track transactions on the blockchain, identifying patterns and potentially suspicious activities.

In Japan, financial authorities and law enforcement agencies deploy these tools to trace the flow of funds and uncover any illicit use of cryptocurrencies. For instance, tools can flag transactions that deviate from typical spending patterns, alerting authorities to possible fraud or money laundering.

Moreover, blockchain analysis tools can provide insights into the addresses involved in transactions, allowing investigators to build profiles on users. These profiles can link to known bad actors or illicit marketplaces, creating a clearer picture of the network of transactions.

Furthermore, some blockchain analysis providers offer collaborative features which allow exchanges and regulatory bodies to share information on flagged addresses and activities, enhancing the overall efficacy of monitoring efforts. By incorporating these tools, Japan can bolster its regulatory frameworks and foster a safer cryptocurrency environment for consumers.

#### How does Japan's approach to cryptocurrency regulation differ from other countries?How does Japan's approach to cryptocurrency regulation differ from other countries?

Japan's approach to cryptocurrency regulation is often seen as progressive compared to many other nations. Unlike countries that have outright banned or heavily restricted cryptocurrencies, Japan has embraced them as a legitimate form of payment. The country was among the first to legally recognize cryptocurrencies under its payment services law.

Japan has established clear guidelines for cryptocurrency exchanges, requiring them to register with the Financial Services Agency (FSA) and comply with strict anti-money laundering (AML) and know-your-customer (KYC) regulations. This transparency is intended to protect consumers and ensure market integrity.

In contrast, countries like China have opted for more prohibitive measures, banning cryptocurrency exchanges and Initial Coin Offerings (ICOs) entirely. This has led to Chinese traders seeking to access global markets via foreign exchanges, creating complexities in regulation and enforcement.

Furthermore, Japan actively collaborates with international regulatory bodies like the Financial Action Task Force (FATF) to set global standards for cryptocurrency regulation, positioning itself as a leader in the space. This contrasts with nations that pursue isolated regulatory strategies, leaving gaps in compliance and enforcement. Japan's holistic and cooperative regulatory framework not only promotes innovation but also enhances consumer protection and market stability.

以上即为围绕“日本监控加密货币”的讨论内容,覆盖了每个相关问题。